Da Form 5498 Filing Extension and Other Relief for Form 1040 Filers PDF 29 MAR 2021 Rollover Relief for Waived Required Minimum Distributions under CARES Act 24 JUN 2020 Form 5498 due date postponed to August 31 2020 Notice 2020 35 PDF 29 MAY 2020 Taxpayer Relief for Certain Tax Related Deadlines Due To Coronavirus Pandemic 14 APR 2020

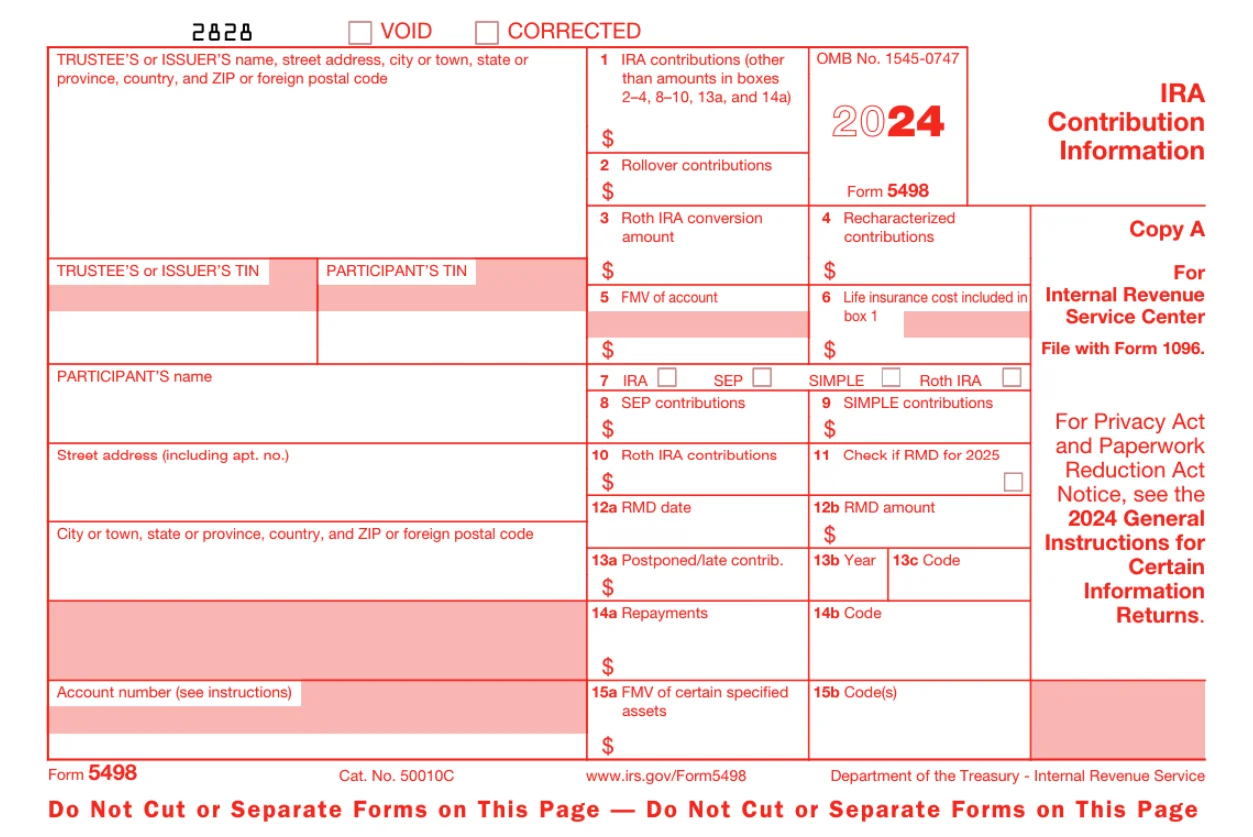

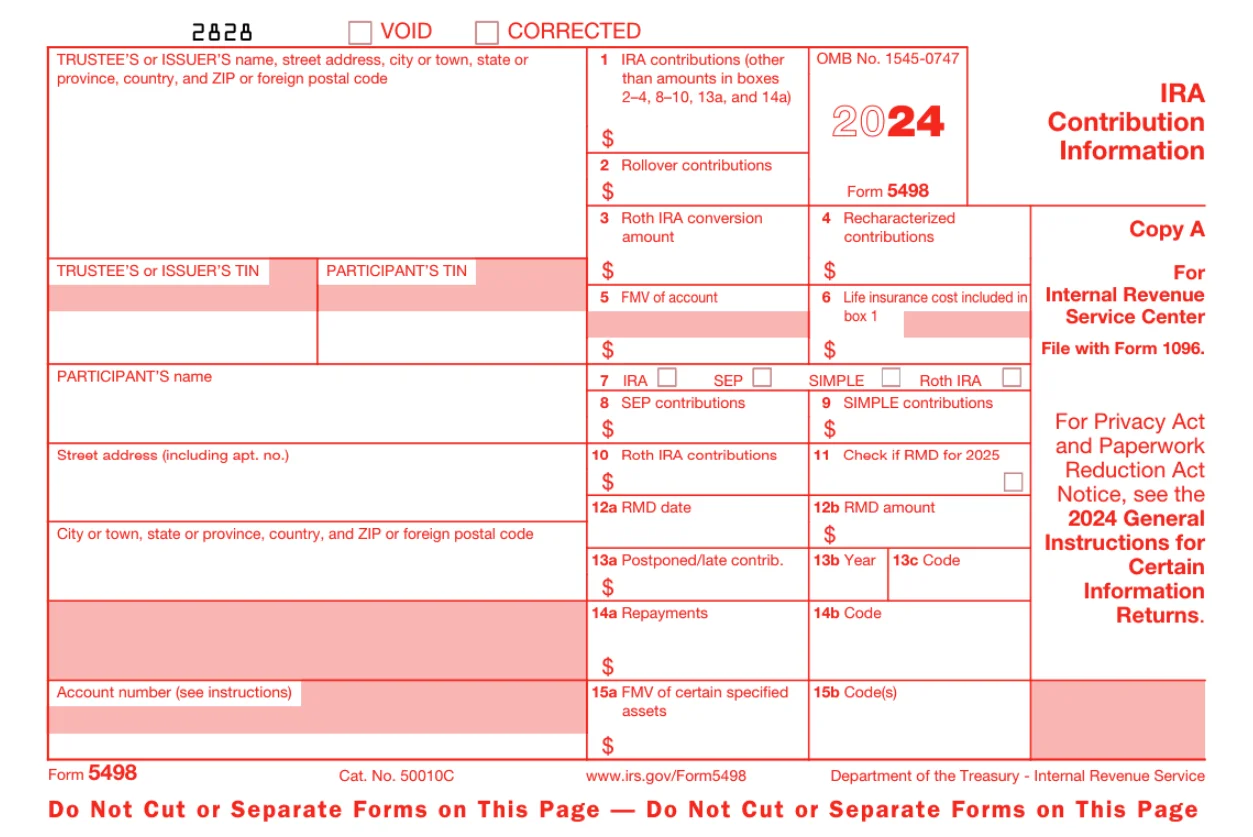

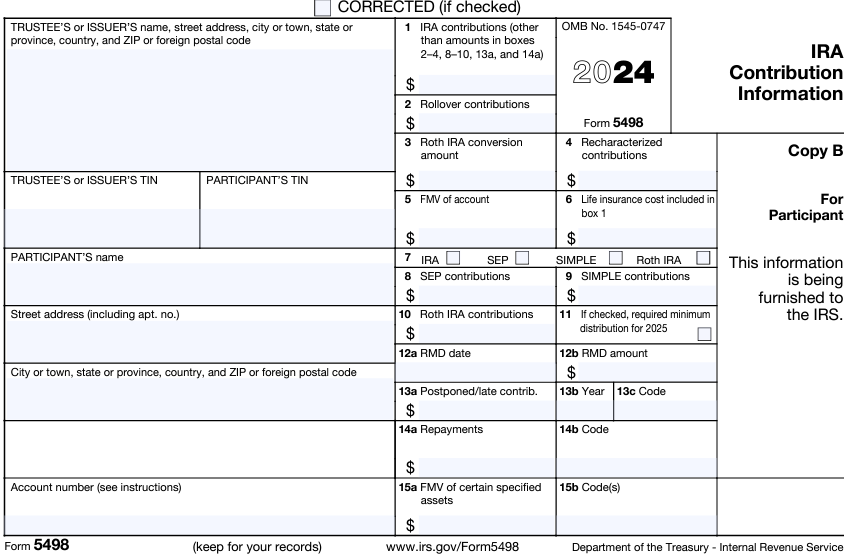

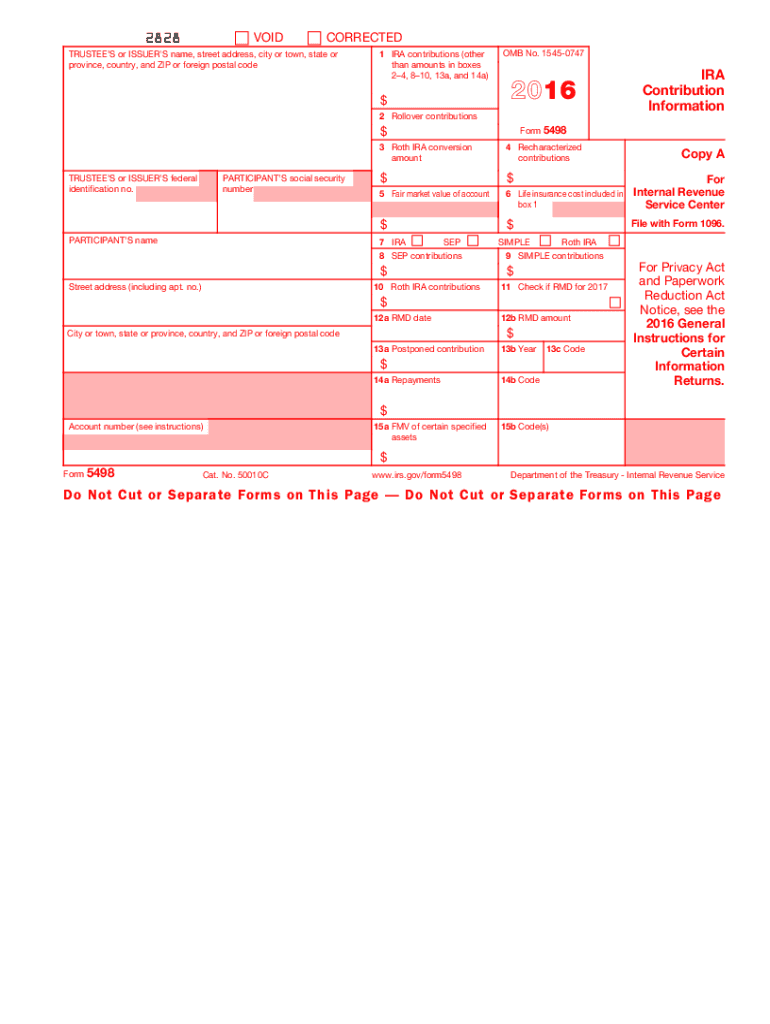

Form 5498 formally called Form 5498 IRA Contribution Information is a document that reports the fair market value of an IRA along with any changes to that IRA including contributions In addition to the 5498 tax form for IRA contributions you may also be issued either of the following Form 5498 ESA This form is issued if you make contributions to a Coverdell Education Savings Account ESA on behalf of an eligible student Distributions from a Coverdell ESA are reported on Form 1099 Q

Da Form 5498

Da Form 5498

https://www.taxbandits.com/Content/NewImages/webp/form-5498-2024-new.webp

What is IRS Form 5498: IRA Contributions Information? | Tax1099 Blog

https://www.tax1099.com/blog/wp-content/uploads/2024/05/1200-X-840.png

https://www.irs.gov/forms-pubs/about-form-5498?os=jva&ref=app

Filing Extension and Other Relief for Form 1040 Filers PDF 29 MAR 2021 Rollover Relief for Waived Required Minimum Distributions under CARES Act 24 JUN 2020 Form 5498 due date postponed to August 31 2020 Notice 2020 35 PDF 29 MAY 2020 Taxpayer Relief for Certain Tax Related Deadlines Due To Coronavirus Pandemic 14 APR 2020

https://www.nerdwallet.com/article/taxes/form-5498

Form 5498 formally called Form 5498 IRA Contribution Information is a document that reports the fair market value of an IRA along with any changes to that IRA including contributions

What is IRS Form 5498?

https://www.dimercurioadvisors.com/hubfs/5498.png

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement IRA to report contributions including any catch up contributions required minimum distributions RMDs and the fair market value FMV of the account For information about IRAs see Pubs 590 A 590 B and 560 Submit Form to IRS After verifying the information submit Form 5498 through Tax1099 s platform Follow the prompts to complete the submission process After successful submission furnish a copy of form 5498 to each IRA account holder by May 31 2024 And don t forget to keep the copies of all filed 5498 for your records

A 1099 R form and a 5498 form are both tax forms used in the United States in relation to retirement plans but they serve different purposes Form 1099 R A Form 1099 R is a tax form used to report distributions from pensions annuities retirement plans IRAs and other similar accounts Form 5498 is informational you don t have to do anything with it but it may help guide your future distribution decisions Let s say you want to withdraw from your Roth IRA Taking out investment earnings beyond your contributions could result in taxes and penalties before retirement age and meeting other criteria If you hold on to your

More picture related to Da Form 5498

Form 5498: Fill out & sign online | DocHub

https://www.pdffiller.com/preview/333/322/333322609/large.png

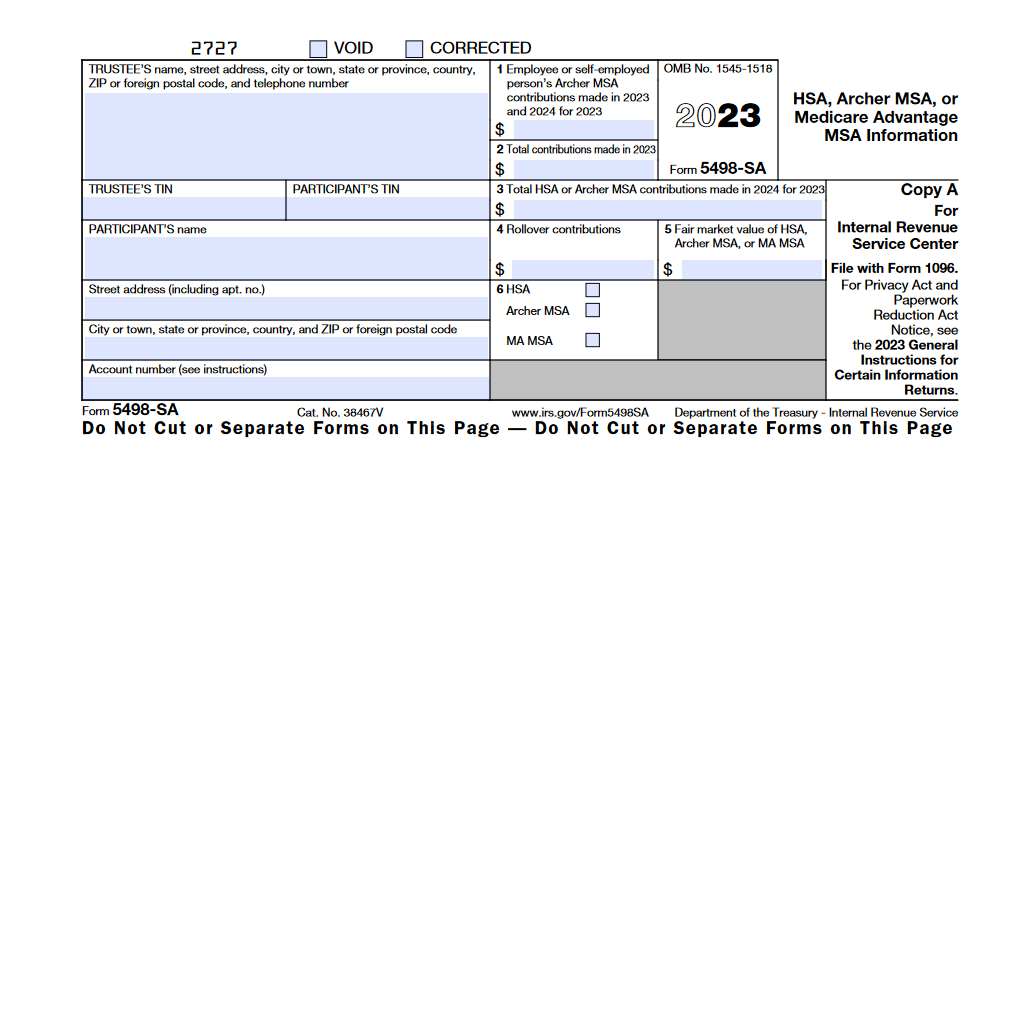

What is Form 5498-SA? Contributions to HSA, MSA and MA MSA... | Tax1099 Blog

https://www.tax1099.com/blog/wp-content/uploads/2024/05/Blog-22May.jpg

IRS Form 5498-SA. HSA, Archer MSA, or Medicare Advantage MSA Information | Forms - Docs - 2023

https://blanker.org/files/images/f5498sa.png

Form 5498 reports various types of IRA contributions you make and other account information in the reporting boxes of the form Box 1 shows the amount you contributed to an IRA Box 9 reports the amounts contributed to a Savings Incentive Match Plan for Employees SIMPLE IRA while box 8 documents Simplified Employee Pension SEP contributions Form 5498 is issued for SEP IRAs to report any employer contributions made on your behalf as well as any rollover contributions or recharacterizations that you make to your own SEP IRA Contributions for the prior year can be made to SEP IRAs by employers up to the tax filing due date of the business plus extensions Per IRS requirements contributions made to a SEP IRA are always reported on

[desc-10] [desc-11]

Attention:

x-raw-image:///e99ee1a60c9dc913e7e3d6828616ae2dce2c0abfd5dad7b39e7d1ee23a320939

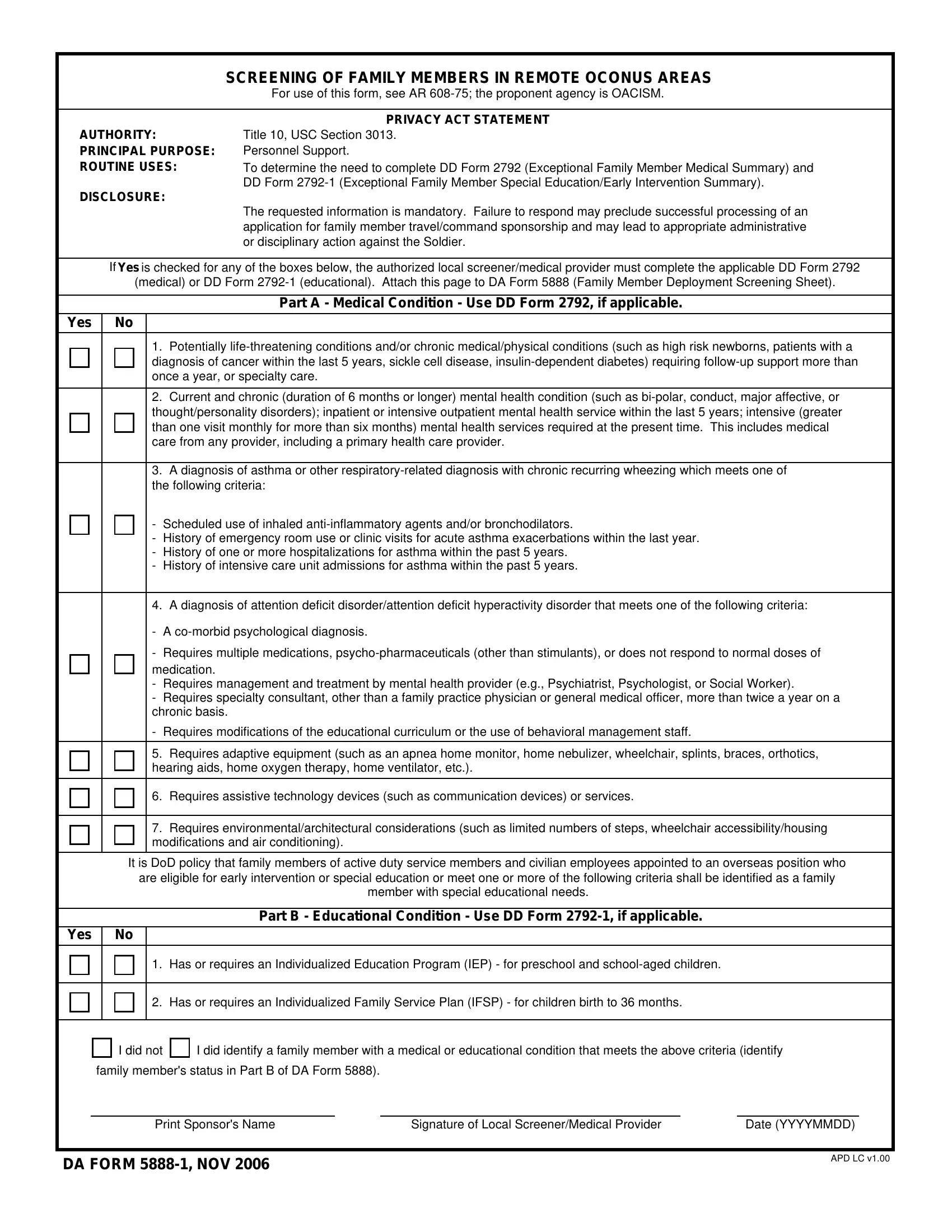

Da Form 5888 1 ≡ Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/da-form-5888-1/da-form-5888-1-preview.webp

What are the tax reporting differences between a W-2 and a 1099 tax form?

Attention:

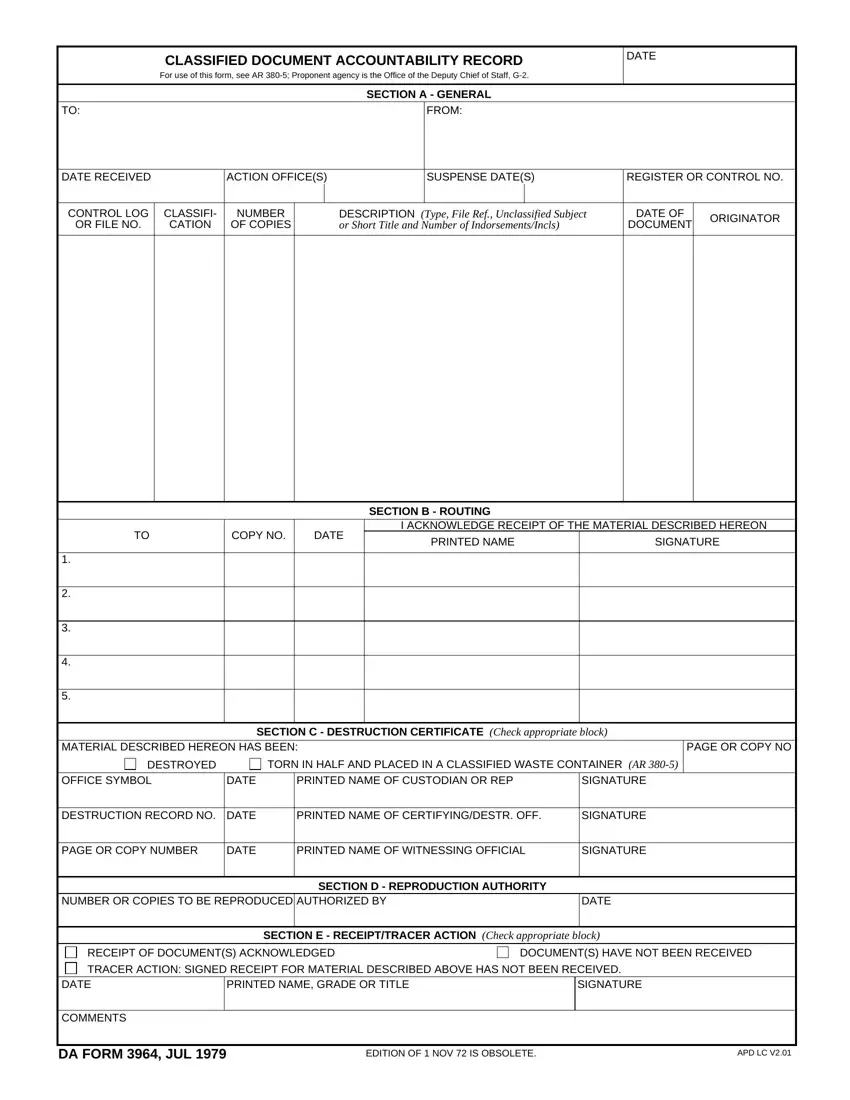

Da Form 3964 ≡ Fill Out Printable PDF Forms Online

Understanding Form 1099-B: What You Need to Know About Proceeds From Broker Transactions

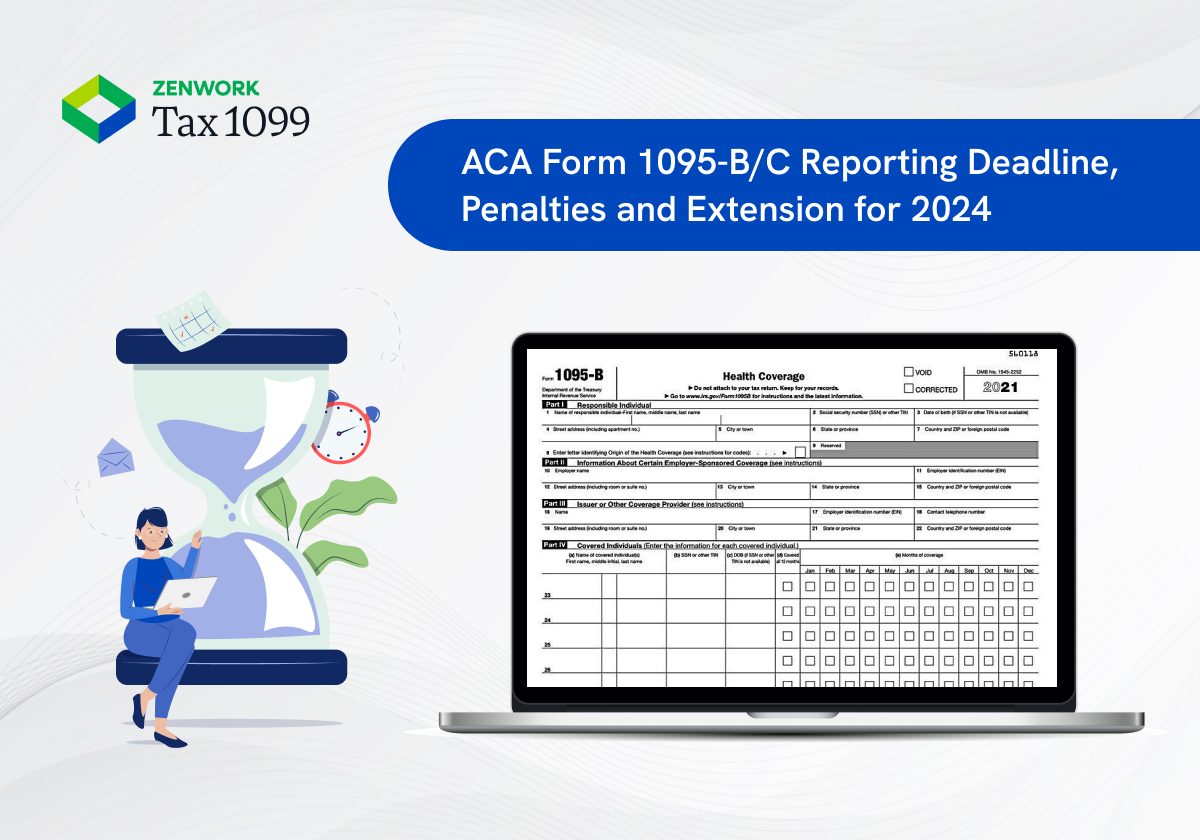

Form 1095-B/C Reorting Deadlines and Extenstions 2024

Form W-9 Complete Instructions - Download FREE PDF

Form W-9 Complete Instructions - Download FREE PDF

Free Fidelity IRA Tax Forms Important Deadlines | PrintFriendly

Da Form 5888 - Fill Online, Printable, Fillable, Blank | pdfFiller

File 944 online - Tax1099

Da Form 5498 - The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement IRA to report contributions including any catch up contributions required minimum distributions RMDs and the fair market value FMV of the account For information about IRAs see Pubs 590 A 590 B and 560